vermont income tax rate 2021

Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates. The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Vermont Estate Tax Everything You Need To Know Smartasset

In the following table we provide the most up-to-date data available on state individual income tax rates brackets standard deductions and personal exemptions for both single and joint filers.

. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. 2019 Income Tax Withholding Instructions Tables and Charts. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table.

2022 Interest Rate Memo. You can use the myVTax website to. This 2021 Vermont Tax Expenditure Report is a continuing effort to catalogue all exemptions exclusions deductions credits preferential rates or deferral of liability as defined in 32 VSA.

Meanwhile total state and local sales taxes range from 6 to 7. 2022 Income Tax Withholding Instructions Tables and Charts. Vermonts 2022 income tax ranges from 335 to 875.

Ad Compare Your 2022 Tax Bracket vs. 2017 VT Rate Schedules. With TurboTax You Can File Free Any Way You Want.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 312 a applicable to the states major tax sources and provide. Thu 12162021 - 1200.

2017-2018 Income Tax Withholding Instructions Tables and Charts. Your average tax rate is 1226 and your marginal tax rate is 22. Income tax tables and other tax information is sourced from the Vermont Department of Taxes.

Notable 2021 State Individual Income Tax Changes. Vermont Personal Income Tax Return Form IN-111 DEPT USE ONLY Vermont Department of Taxes 2021 Form IN-111 Vermont Income Tax Return 211111100 2 1 1 1 1 1 1 0 0 Please PRINT in BLUE or BLACK INK FILE YOUR RETURN ELECTRONICALLY FOR A FASTER REFUND. Find your pretax deductions including 401K flexible account contributions.

GO TO TAXVERMONTGOV FOR MORE INFORMATION. Ad For Simple Returns Only File Free Even When An Expert Does Your Taxes. Discover Helpful Information and Resources on Taxes From AARP.

2017 VT Tax Tables. To avoid paying interest and penalties have both your taxes paid and your return filed by April 18 2022. Check the 2021 Vermont state tax rate and the rules to calculate state income tax.

Start Today And File w Confidence. Several states changed key features of their individual income tax codes going into tax year 2021. Found inside Page 30-643 State taxation of LLCs.

2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Detailed Vermont state income tax rates and brackets are available on this page. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be.

Tue 12212021 - 1200. 2017-2018 Income Tax Withholding Instructions Tables and Charts. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Find your income exemptions. Income is subject to four tax rates in the state. Your 2021 Tax Bracket to See Whats Been Adjusted.

2016 VT Rate Schedules and Tax Tables. Vermont Income Tax Calculator 2021 If you make 72000 a year living in the region of Vermont USA you will be taxed 11568. The tax schedules are designed so that Rate Schedule 3 provides an equilibrium of funding across the.

A financial advisor in Vermont can help you understand. 2021 VT Tax Tables. Find your gross income.

The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law. As you can see your Vermont income is taxed at different rates within the given tax brackets. Tax Rates and Charts.

Find your pretax deductions including 401K flexible account contributions. Individuals filing state returns submit Vermont Form IN-111. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax Find.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Tax Rates and Charts. The state taxes to which an LLC and its members are potentially subject with respect to LLC income depends on the state or.

Tue 01252022 - 1200. 2021 Vermont Tax Tables. The previous 882 rate was increased to three graduated rates of 965 103 and 109.

The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket. Tax Year 2021 Personal Income Tax - VT Rate Schedules. Tax Rates and Charts.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vermont Income Tax Brackets 2020

Vermont Tax And Labor Law Guide Care Com Homepay

Personal Income Tax Department Of Taxes

Vermont Income Tax Calculator Smartasset

Vermont Retirement Tax Friendliness Smartasset

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Qua Healthcare Education Health Care Social Determinants Of Health

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Personal Income Tax Department Of Taxes

Publications Department Of Taxes

The States That Value Long Term Caregiving The Most Long Term Care Long Term Care Insurance Primary Caregiver

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

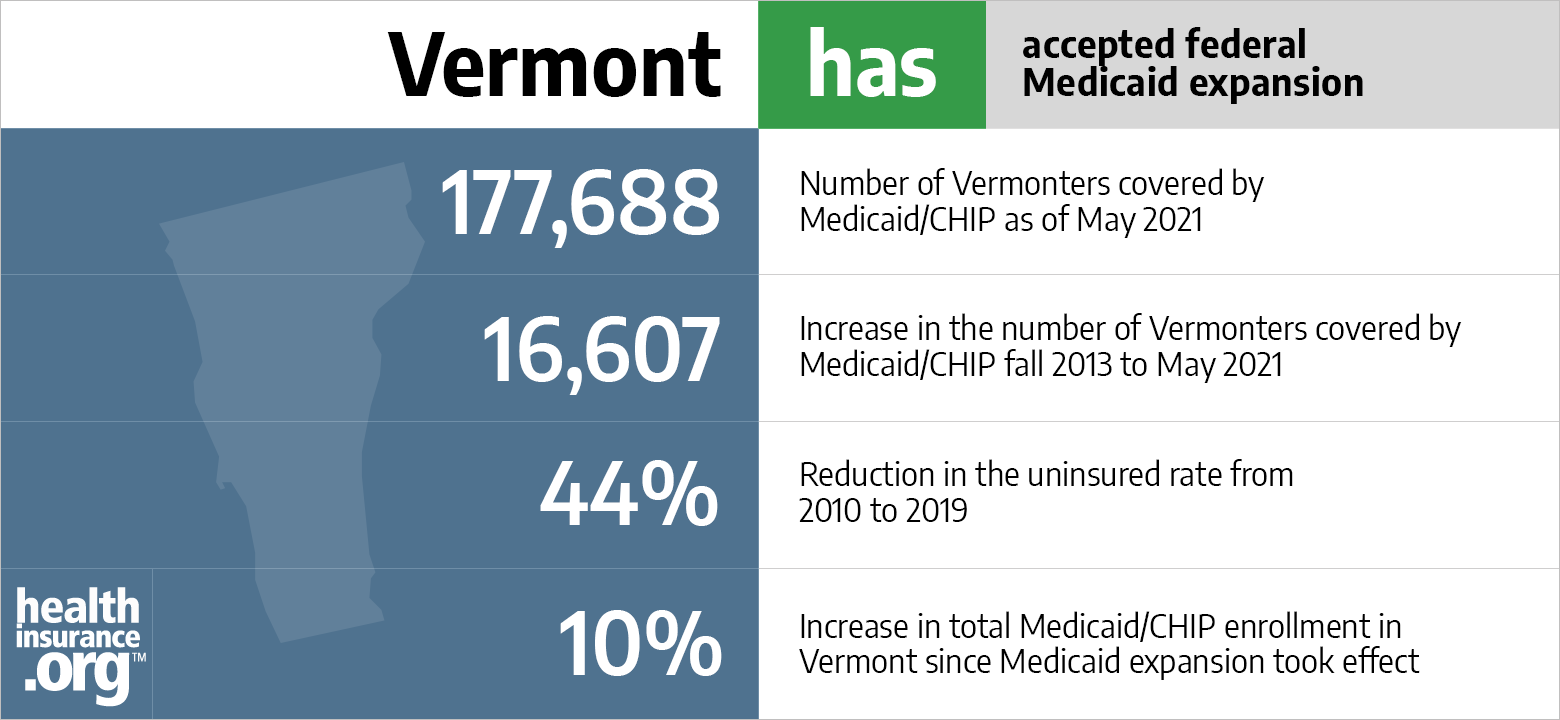

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency